Environmental Tax for Pollution in the Extraction of Stone Materials

Subject

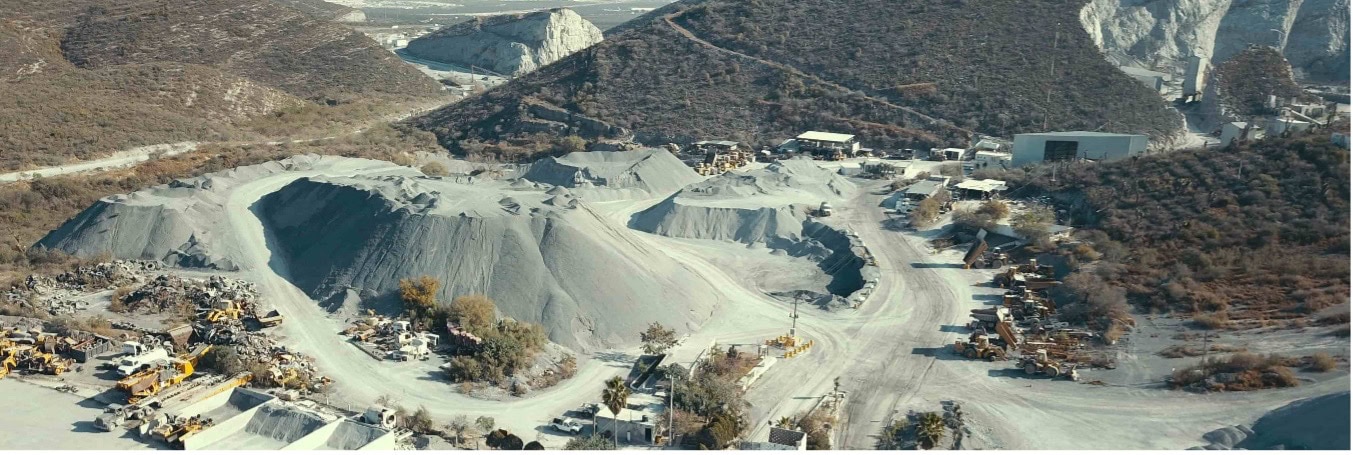

The natural and legal persons or economic units that within the territory of the State carry out the extraction, exploitation or use of stone materials.

Object

Extraction of stone materials: building and ornamental stones, marble, canteras, arenas, granite, it matters, blackboards, clays that do not require underground work, limestones, puzolanas, crowds, siliceous sands, onyx, travertines, tezontle, tepetate, dimensioned stones or of any other species that are not precious, mixtures of non-metallic minerals and earthy substances, and other non-metallic minerals.

Tax

This tax will be caused with a rate of 1.5 fees for each cubic meter or fraction that is extracted from the materials subject to the tax, from the first complete unit of cubic meter.

Particular obligations

- Submit the environmental impact authorization issued by the competent authority;

- Keep a record of extraction in which the quantity in cubic meters of material that is extracted will be recorded daily.;

Tax for the Emission of Pollutants into the Atmosphere

Subject

natural persons, legal entities and economic units that have installations or fixed sources in the territory of the State in which activities that generate polluting emissions into the atmosphere are carried out.

Object

Emissions into the atmosphere, which are considered to be the direct expulsion of the following pollutants that affect air quality:

- Particles smaller than 10 micrometers (PM10);

- Particles smaller than 2.5 micrometers (PM2.5);

- Total Suspended Particles (PST);

- Nitrogen oxides; Y

- Sulfur dioxide.

Tax

A rate of 2.79 fees for each ton or fraction of particles emitted, from the first full ton that exceeds the maximum limit allowed by the NOM-043-SEMARNAT-1993 and NOM-085-SEMARNAT-2011.

Particular obligations

Keep a Record of Contaminant Emissions, in which they must include the following:

a. Calculation of emissions into the atmosphere carried out in compliance with the provisions of this Law;

b. in your case, concentration data resulting from monitoring or measuring equipment installed; Y

c. Any other that is established through regulatory publication by the Secretary of Finance and General Treasury of the State or the Secretary of the Environment.

Of the Tax for the Emission of Contaminants in the Water

Subject

natural persons, legal persons, as well as the economic units that, in the territory of the State, regardless of tax domicile of the taxpayer, under any title, by themselves or through intermediaries, carry out the emission of polluting substances that are deposited, disposed of or discharged into the water on the territory of the State.

Object

The emission of polluting substances that are deposited, disposed of or discharged into the water on the territory of the State, which are considered the following:

A) Basic contaminants: Contaminant Number of milligrams per liter per cubic meter

- Fats and oils 25

- Total Suspended Solids 60

- Biochemical Oxygen Demand 5 60

- total nitrogen 25

- total phosphorus 10

b) Heavy metal and cyanide contaminants: Contaminant Number of milligrams per liter per cubic meter

- Arsenic 0.2

- Cadmium 0.2

- Cyanide 2.0

- Copper 6.0

- Chrome 1.0

- Mercury 0.01

- Nickel 4

- Lead 0.4

- Zinc 20

Tax

The tax to be paid will be obtained by applying a fee for the equivalent of 1.10 quotas for each cubic meter or fraction affected, from the first complete unit of cubic meter affected.

If the water was contaminated with two or more of the substances mentioned in this article, the fee will be paid for each contaminant..

Particular obligations

Keep a specific record of the polluting substances mentioned in this Section, that are acquired and used in the production processes, its use and destination, as well as the quantities that in solid physical state, semi-solid or liquid poured into the water;

Of the Tax for the Emission of Pollutants in the Subsoil and/or Soil

Subject

natural persons, legal persons, as well as the economic units that, in the territory of the State, regardless of tax domicile of the taxpayer, under any title, by themselves or through intermediaries, emit organic and inorganic polluting substances that are deposited, disposed of or discharged into the subsoil and/or soil in the territory of the State.

Object

The emission of organic and inorganic polluting substances that are deposited, disposed of or discharged into the subsoil and/or soil in the territory of the State, that are goods of common use, goods intended for a public service and own goods belonging to the Federation, to the states or municipalities, or real estate that is abandoned. These contaminants are considered:

- Pollutants discharged into the subsoil and/or affected soils:

- Subsoil or soil contaminated by hydrocarbons: NOM-138-SEMARNAT / SSA1-2012.

- Subsoil and/or soil contaminated by: arsenic, bario, beryllium, cadmium, hexavalent chromium, mercury, nickel, the payment, lead, selenium, thallium and vanadium. NOM-147-SEMARNAT / SSA1-2004

2. Organic or inorganic waste dumped on the ground per kilogram in every hundred square meters of affected land.

Tax

The tax to be paid will be obtained by applying 1.10 quotas for each kilogram or milligrams per kilogram as appropriate, of contaminant in one hundred square meters of affected land, from the first complete unit of milligrams per kilogram, for every one hundred square meters of affected land.

If the subsoil and/or soil are contaminated with two or more of the substances mentioned in this article, the fee will be paid for each pollutant.

Particular obligations

Keep a specific record of the polluting substances mentioned in this Section, that are acquired and used in the production processes, its use and destination;

In addition to the particular obligations indicated for each tax, those subject to them must comply with the following obligations:

- Enroll in the RFC;

- Individuals and legal entities or economic units that have their fiscal domicile in other entities, but that carry out the activities subject to the tax, must register domicile within the State;

- Submit tax returns, find out and pay the corresponding tax;

- Submit notices, data, documents and reports requested by the tax authorities in relation to this tax, within the deadlines and in the places indicated;

- Make available to the competent authorities, the reports, documents, Records and proofs that are requested, in relation to the determination and payment of this tax, for the purposes of exercising its powers of verification;

- The others that are indicated in the law and the other applicable ordinances.

The payment of these taxes must be made through a monthly declaration, withdrawal and indemnities or other payments 17 of the following month, which must be submitted in the forms and means authorized by the Secretary of Finance and General Treasury of the State.

To determine the tax base, the tax authorities may consider:

- The books and records whatever their denomination, that the subjects obliged to pay the taxes must carry in accordance with the legal provisions are of a fiscal nature, business or to comply with the NOMs in terms of ecology and environment;

- When it is not possible to determine the tax base, the tax authorities will be able to estimate the ecological taxes based on the Environmental Impact Statements, Annual Operation Certificates and other documents of an environmental nature that taxpayers are obliged to generate.

Contact us for questions or more information,

Partner in taxes C.P. Mario Enrique Morales mario.morales@bmtc-dfk.com

Marketing and Media Carla Torres carla.torres@bmtc-dfk.com